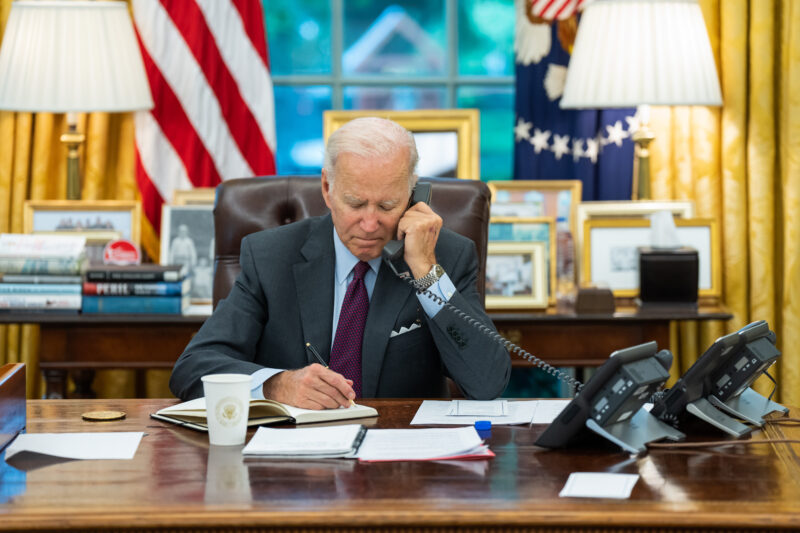

WASHINGTON — America’s gross national debt exceeded $31 trillion for the first time on Tuesday, a grim financial milestone that arrived just as the nation’s long-term fiscal picture has darkened amid rising interest rates.

The breach of the threshold, which was revealed in a Treasury Department report, comes at an inopportune moment, as historically low interest rates are being replaced with higher borrowing costs as the Federal Reserve tries to combat rapid inflation. While record levels of government borrowing to fight the pandemic and finance tax cuts were once seen by some policymakers as affordable, those higher rates are making America’s debts more costly over time.

Adquiere tu libro “Cartas a un Hijo”. En las principales plataformas de EBook

“So many of the concerns we’ve had about our growing debt path are starting to show themselves as we both grow our debt and grow our rates of interest,” said Michael A. Peterson, the chief executive officer of the Peter G. Peterson Foundation, which promotes deficit reduction. “Too many people were complacent about our debt path in part because rates were so low.”

The new figures come at a volatile economic moment, with investors veering between fears of a global recession and optimism that one may be avoided. On Tuesday, markets rallied close to 3 percent, extending gains from Monday and putting Wall Street on a more positive path after a brutal September. The rally stemmed in part from a government report that showed signs of some slowing in the labor market. Investors took that as a signal that the Fed’s interest rate increases, which have raised borrowing costs for companies, may soon begin to slow.